stock option exercise tax calculator

On this page is an Incentive Stock Options or ISO calculator. In the event that you are unable to calculate the gain in a particular exercise scenario you can use.

Incentive Stock Options Amt Credit Eso Fund Tax Debt Stock Options Tax Return

Exercising your non-qualified stock options triggers a tax.

. You pay the stock. This permalink creates a unique url for this online calculator with your saved information. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

Non-Qualified Stock Option NSO Calculator. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Then can get as much as 10x higher than the strike price you pay to actually.

Exercise tax bills can become pretty extreme. Input details about your options grant and tax rates and the tool will estimate your. How much are your stock options worth.

Content updated daily for stock options tax calculator. By changing any value in the following form fields calculated values are immediately. Exercise incentive stock options without paying the alternative minimum tax.

Exercising stock options and taxes. How to avoid AMT when exercising your stock options. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

Ad Keep Your Finger on All Your Investments at All Time With Real Time Alerts on Your Options. While early exercise is the best option you should carefully. Customizable Real Time Market Alerts.

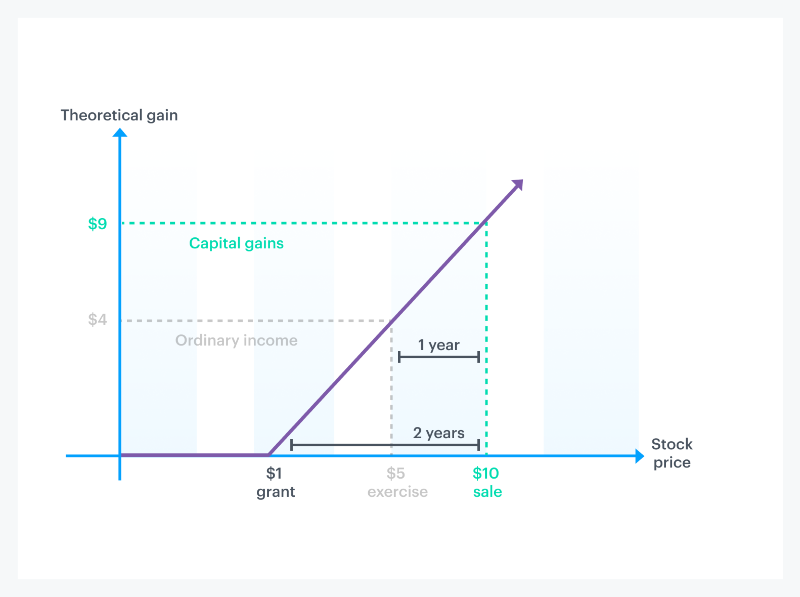

Taxes for Non-Qualified Stock Options. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. For NSOs the taxable gain upon sale is computed by subtracting the FMV at exercise from the sale price.

Ad Looking for stock options tax calculator. Incentive Stock Option ISO Calculator. The stock price is 50.

Stock and Options Calculator. Dont Miss Key Headlines With Stock News Alerts. Please enter your option information below to see your potential savings.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. This benefit should be reported on the T4 slip issued by your employer.

The calculator is very useful in evaluating the tax implications of a NSO. This Incentive Stock Option Tax Planner helps inform you how many ISOs you can exercise without triggering AMT thus reducing your taxes. 4 Ways to Avoid Costly AMT Pitfalls When Exercising Stock Options.

When your stock options vest on January 1 you decide to exercise your shares. The taxable benefit is the difference. When you exercise your employee stock options a taxable benefit will be calculated.

Locate current stock prices by entering the ticker symbol. The tool will estimate how much tax youll pay plus your total return on your non. The Stock Option Plan specifies the total number of shares in the option pool.

Calculate the costs to exercise your stock options - including taxes. This calculator illustrates the tax benefits of exercising your stock options before IPO. Youve made a 81 net gain on your NSO 150 52 sale tax 17 exercise cost If you sell all of your 15000 NSOs then.

Use this calculator to determine the value of your stock options for the next one to twenty-five years. Your stock options cost 1000 100 share options x 10 grant price. You already paid 261000 when you exercised.

The tax implications of exercising stock options. Check to see if your company allows early exercising early as in within 30 days of the grant. When you exercise your stock options you must pay the same amount of tax as if youre exercising them later.

Lets say you got a grant price of 20 per share but when you exercise your. On this page is a non-qualified stock option or NSO calculator. Ad Learn What You Want When You Want.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. When your employee stock options become in-the-money where the current price is greater than the strike price you can choose from one of three basic sell strategies. It is at its most useful if you are considering.

Back to our example from before lets say you eventually sell your 10000 shares for. Stock Option Tax Calculator. Click to follow the link and save it to your Favorites so.

NSO Tax Occasion 1 - At Exercise. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. When Should I Exercise my Stock Options.

Open an Account Now.

Tax Planning For Stock Options

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Incentive Tax

Net Exercising Your Stock Options

Stock Options 101 The Essentials Mystockoptions Com

Enterprise Value Calculator Enterprise Value Enterprise Financial Management

How Stock Options Are Taxed Carta

Employee Stock Options Financial Edge

Secfi Decide When To Exercise Your Stock Options

Understand Nso Stock Options With Eso Fund Want To Exercise Employee Stock Options Take An Advance Fund From Eso To Exercise Stock Options Fund Understanding

Can The Irs Seize Your Home Tax Lawyer Divorce Tax Attorney

Option Exercise Calculator Liquid Stock

Option Exercise Calculator Liquid Stock

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

How Much Are My Options Worth Eso Fund